Insider Trading Tips

Global Earnings Surge: UK & US Stocks Above 200‑EMA Set for Momentum Plays

Global Earnings Surge: UK & US Stocks Above 200‑EMA Set for Momentum Plays

This week marks a pivotal phase of Q2 earnings, with key reports due out of both UK and US markets. At Quantina.co.uk, we overlay earnings calendars with a daily 200‑EMA filter to highlight stocks with strong technical backing.

UK Earnings Calendar

- Curry’s (CURY) – July 3

- Watches of Switzerland (WOSG) – July 3

- JD Sports (JD) – early July

✅ UK Stocks Above 200‑Day EMA

- 0HAF: £4.40 vs EMA £4.38

- 0HCT: £60.58 vs EMA £59.75

- 0HCZ: £194.94 vs EMA £191.18

US Earnings Calendar (June 30–July 2)

- June 30: Progress Software (PRGS)

- July 1: Constellation Brands (STZ), MSC Industrial (MSM), Greenbrier (GBX)

- July 2: UniFirst (UNF)

✅ US Stocks Above 200‑Day EMA

- Equinix (EQIX) – ~US$906

- KLA Corp (KLAC) – ~US$889

- Intuit (INTU) – ~US$759

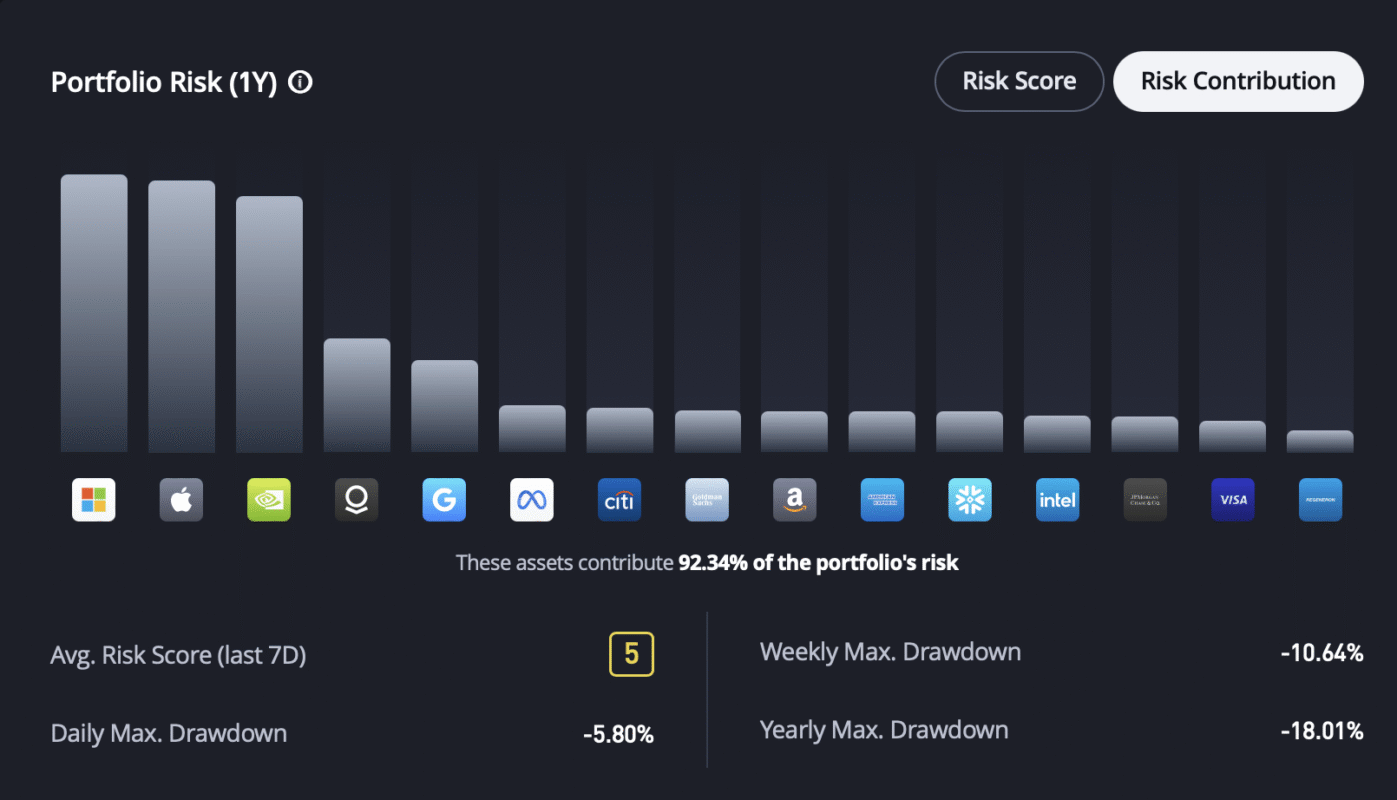

US Market Breadth & 200‑EMA Context

Currently, about **51% of S&P 500 stocks trade above their 200‑day EMA**—a sign of moderate but stable breadth [oai_citation:0‡fidelity.com](https://www.fidelity.com/viewpoints/active-investor/moving-averages?utm_source=chatgpt.com). Maintaining above the 200‑EMA continues to be a bullish backdrop for our selected names.

Sample Chart: S&P 500 Trend + 200‑EMA

An illustrative S&P 500 chart holding above its 200‑day EMA—affirming the technical backdrop ().

Quantina’s Tactical Watchlist

- UK picks: 0HAF, 0HCT, 0HCZ—momentum ready ahead of July 3 results

- US picks: EQIX, KLAC, INTU—technically positioned for earnings-driven moves

- Strategy: Consider **momentum entries** ahead of earnings, with **protective stops just below EMA**

- Risk Control: Track pre-earnings implied vol; consider **long straddles** or **stop-limit setups** to manage uncertainty

️ Key Dates Ahead

- UK: July 3 – CURY, WOSG earnings

- UK: Early July – JD Sports

- US: June 30 – PRGS; July 1 – STZ, MSM, GBX; July 2 – UNF

Final Take

Blending **earnings catalysts** with **technical strength above 200‑EMA** uncovers high-probability setups. Quantina AI helps spot these across global markets—track them via our Trading Signals page.

For real-time alerts, subscribe to our Quantina Newsletter.

Disclaimer: Educational purposes only—it’s not financial advice. Always do your own due diligence.